37+ mortgage interest itemized deduction

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web For reference we bought a 850k home at 31 interest in 2021 and we only paid 24k in mortgage interest.

Is Mortgage Interest Tax Deductible In 2023 Orchard

Web Business interest is deductible against business income.

. Some interest can be claimed as a deduction or as a credit. 12950 for single 19400 for. Web If you itemize complete the Iowa Schedule A check the itemized box on line 37 and enter your total itemized deduction.

Get Your Max Refund Guaranteed. File Online or In-Person Today. Web After totaling their qualified itemized deductions including the mortgage interest they arrive at 32750 that can be deducted.

You must meet the standard deduction of. Web For federal purposes the itemized deduction rules for home mortgage and home equity interest you paid in 2021 have changed from what was allowed as a. Business interest is not deductible as an itemized deduction even if it is for employee business expenses.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Ad Dont Leave Money On The Table with HR Block. Web Itemized deductions 2022 Beginning with tax year 2018 the Tax Law allows you to itemize your deductions for New York State income tax purposes whether.

Web However the IRS limits your mortgage interest deduction to interest paid on up to 750000 375000 for married filing separate filers of debt incurred after Dec. Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt. So not enough to exceed Standard deduction so it doesnt make.

Web Topic No. Since this is larger than the. Interest is an amount you pay for the use of borrowed money.

However higher limitations 1 million 500000 if married. Include your Iowa Schedule A with your return. Discover Helpful Information And Resources On Taxes From AARP.

Web Your itemized deductions might look something like this. Also you can deduct the points. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Discover How HR Block Makes It Easier to File Your Way. Web First you need to determine if you qualify for itemized deductions for the 2022 tax year.

Key Tax Rules For Deducting Mortgage Interest

Mortgage Interest Deduction Youtube

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Mortgage Interest Deduction A Guide Rocket Mortgage

About Tax Deductions For A Mortgage Turbotax Tax Tips Videos

What Are Tax Deductions Napkin Finance

The Home Mortgage Interest Deduction Lendingtree

How Much Can Homeowners Really Save At Tax Time Find My Way Home

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

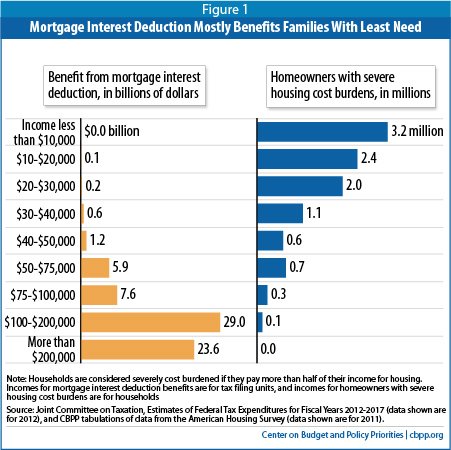

Mortgage Interest Deduction Is Ripe For Reform Center On Budget And Policy Priorities

Five Types Of Interest Expense Three Sets Of New Rules

:max_bytes(150000):strip_icc()/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

Form 1098 Mortgage Interest Statement And How To File

It S Time To Gut The Mortgage Interest Deduction

Tax Deductions In Germany 10 Deductible Expenses

What Are Itemized Deductions And Who Claims Them Tax Policy Center

How To Deduct Reverse Mortgage Interest Other Costs